cTrader- A Detailed Review of the Forex Trading Platform!

cTrader is a currency trading platform built by cTrader Limited, a firm based in London, which specialises in forex trading. The platform distinguishes itself from the competition since it has been specifically created for usage with ECN brokers. In the years following its initial introduction with FxPro, cTrader has gained traction among other top ECN brokers, including Liquid Markets, Pepperstone, IC Markets and Admiral Markets.

The cTrader platform is intended to perform two functions: first, the execution of trades, and second, the charting of financial markets.

It has an uncluttered interface that is very easy on the eye, and it is quite easy to use. cTrader has a very clean and attractive visual appearance. The designers have gone to considerable lengths to ensure that the entire platform is simple and straightforward to navigate.

When we initially started using MetaTrader several years ago, we found it to be far more difficult to understand than the current learning experience with cTrader. After a few hours of use, MetaTrader, on the other hand, becomes clumsy and inefficient.

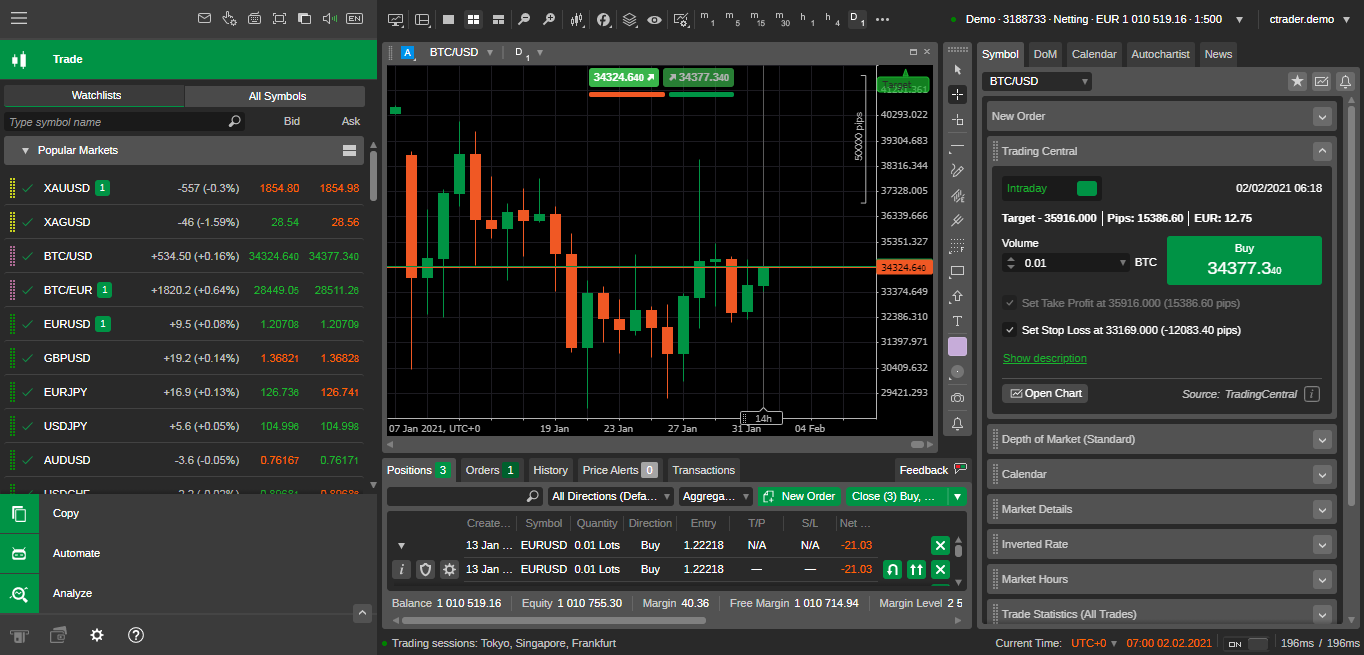

cTrader’s Default Layout

There are a number of different layouts to pick from. Technical traders who are uninterested in news and fundamental analysis may prefer to employ the chart trading arrangement depicted in the following example:

Execution of Trades

It is similar to MetaTrader’s Market Watch window in that it is located on the left side of the interface and displays a list of currency pairings or other instruments with bid/ask quotations in a vertical column.

When you click on any of the pairs, the quote will enlarge, allowing you to place an immediate purchase for them. Listed below is the column with the GBPUSD pair extended to reflect the “depth of market around the present market price,” as indicated by the symbol:

cTrader Currency Exchange Rates

You can submit an instant market order with either a single click or a double click (you can decide which) on the Buy or Sell quote. What’s particularly good is that the following information about the order that was executed appears in the upper right corner of the screen. Instead of an automatic execution, you can set a safe setting that causes a regular entry order box to appear rather than an automatic execution.

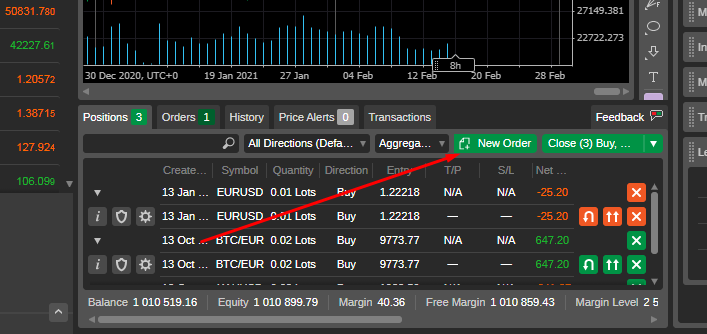

Orders that are currently pending

Take-profit and stop-loss orders can be modified directly on the chart by dragging and dropping boxes that appear when the mouse is hovered over the opening position on the chart, as well as when placing a new order by selecting the place new order tab from the order list.

No action is required on your part – when you click the stop loss or take profit buttons, the other is immediately cancelled. Needless to say, extreme caution must be exercised: for example, you must ensure that each portion of your order is the correct size. Once you’ve made a few trades, however, the process becomes much more straightforward.

All pending orders are visibly represented on the chart, making it simple to keep track of which orders are where and what size they are. There are additional tabs for Positions, Orders, and Transactions, which will assist you in keeping track of your transactions.

Pending Orders on the cTrader

When you right-click on the open chart of the instrument for which you wish to place a stop order, a stop order will be generated.

The Favourites column is a feature that makes order entry much simpler – you can create a separate Favourites column for the pairs that you trade the most frequently, and the quote box in this column will always be expanded to give you quick access to your most frequently traded pairs whenever you need it.

Charting

The charting tools are comprehensive and straightforward to use. cTrader is available in three different modes: multi-chart, single-chart, and free-chart. You have the option of viewing many charts neatly tiled next to each other or having the chart space filled with just one chart and navigating between other charts as needed.

cTrader Charting Instruments

You may also detach any chart from the platform and display it in a separate window outside the platform. This is particularly useful because, on Windows, the detached chart produces its own tab at the bottom of the Taskbar, which is really convenient.

Change the colour settings of each chart from the standard green and red bars on a black backdrop to something more customised to fit your needs and preferences properly.

When you start a new chart, the colour settings are always set to the default view; if you have a preferred colour scheme that is different from the default, you must alter it for each new chart that you open. When you close the platform, however, it reopens in the same state as when you closed it.

Most charting software offer intervals of 1, 5, and 15 minutes in addition to the standard 1-hour timeframe. This is the same with cTrader, but you also have the option of choosing from time frames ranging from 45, 20, and 10 seconds to 1 minute and even ticks.

Above the 1-hour level, you’ll find the normal 4-hour, daily, weekly, and monthly views, as well as a weekly and monthly calendar. However, using cTrader, you have access to a number of interesting higher timeframe options as well.

The indicator list covers more than 50 indications, which are divided into four categories: trend, oscillator, volatility, and volume. Trend indicators are the most commonly used indicators.

In addition, there is a section marked “Other.” Every type of indicator imaginable is available, including Moving Averages, MACD, Stochastics, Bollinger Bands, and a countless number of others. To determine whether or whether your trading requirements are met by the demo version of cTrader, you should first download the demo version of cTrader and test it out.

Trading

We put cTrader through its paces on their own demo account. If it’s any consolation, we thought their executions were fair and swift. Of course, because this platform is intended to be used in conjunction with ECN brokers, you can anticipate fair and genuine execution, which can work to your favour if you understand how to trade in the real market.

This function was added to cTrader’s latest update in November, and it allows traders to draw on charts in a free-form manner, rather than being restricted to predefined shapes or symbols, as previously. Trading with this new tool will allow traders to completely customise their charting experience while also being able to record more specific comments about current and potential trades.

The new update also included enhancements to the platform’s copy trader features, including the addition of the Date of Copying, which allows traders to more easily trace replicated trades and the associated management costs associated with them.

The Bottom Line

For the record, as a full-time trader, we can honestly declare that this is more enjoyable to use, as well as technically slightly more adaptable, than MetaTrader 4 or any other proprietary platform that we have ever traded on. It is simple to use, and it is pleasing to the sight. It combines the fluid graphics of web-based platforms with the smooth operation of a well-designed application to create a seamless experience.

While it is evident that the corporation put a great deal of time, thought, and energy into developing the platform, their efforts have been tremendously fruitful in the long run. We would strongly encourage you to experiment with the cTrader platform.