Given how simple it is to locate an online stock broker, determining which online stock broker is the greatest fit for you may necessitate a little of investigation. You may use this to locate the finest stock broker for you and the best trading platform for your needs. You want internet trading to be as simple as possible, whether you’re trading penny stocks or an exchange-traded fund (ETF).

Keep in mind, however, that the top brokers should be a good match for your requirements. It is possible that the broker who is popular among your neighbours will not be a good fit for you, which is why you have a variety of options. Stock trading is highly subjective in many respects, and you want a trading tool, investor support, and other features in your online brokerage account, among other things.

So, without further ado, let’s look at the top online trading platforms!

1. Webull- The best option for mobile traders

Traders at the intermediate and advanced levels will appreciate the highly intuitive nature of Webull’s mobile and desktop applications. The Webull platforms contain fundamental and technical analysis tools, including as advanced charting and technical indicators, to help you make informed decisions.

Users of Webull’s platforms are able to trade more than 5,000 equities, exchange-traded funds (ETFs), stock trading, and options trading without paying any commissions. Additionally, you may register an account without making an initial deposit and test out their platforms in a paper trading account, which allows you to experiment without risking any of your own money.

A margin account, which allows you to short stocks, can be opened with as little as $2,000, but you’ll need to deposit a minimum of that amount. The company’s promotional offerings also include a 1-free-share-of-stock incentive for successfully opening an account, which is chosen by a random selection process using the company’s lottery system.

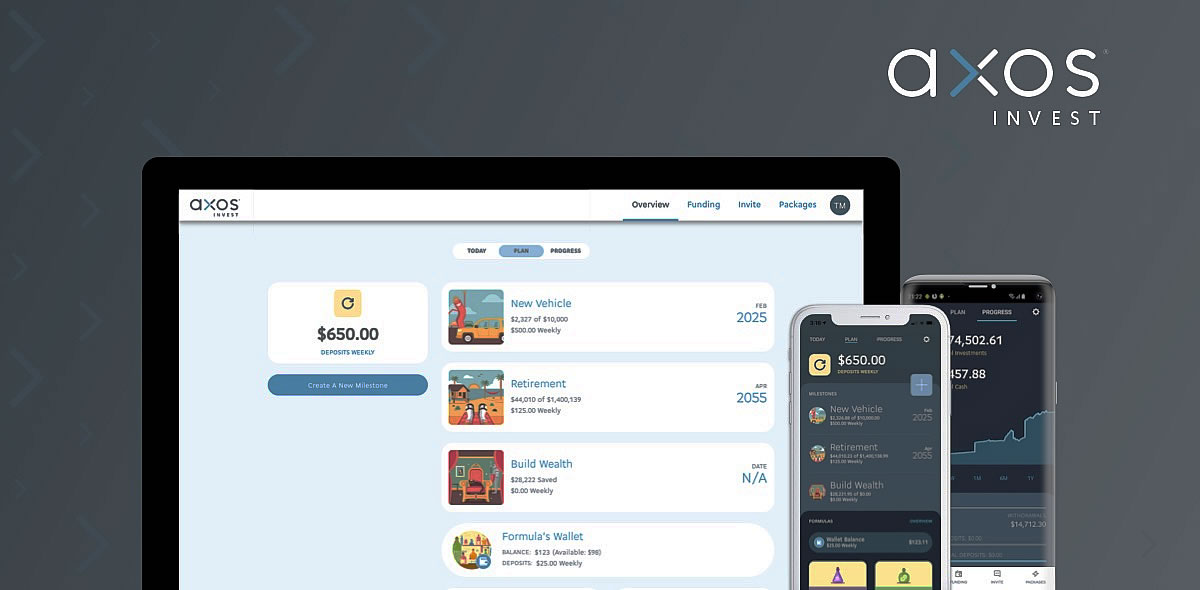

2. Axos Self-Directed Trading- The best self-directed trading platform available

The digital, self-directed trading environment is where some of today’s most knowledgeable market watchers turn when they’re ready to take complete control of their financial future. Introducing Axos Invest, a lively new online trading platform from Axos Bank that provides all the tools you need to develop and manage your financial future while also providing access to information and insights that will help you ensure your instincts and judgments are correct.

Axos Invest is well-known for its minimal fees, which include:

- Trade stocks and exchange-traded funds (ETFs) without paying commissions.

- Only $1 is charged for each option contract.

- Trades in mutual funds cost $9.95 per transaction.

In addition to individual and joint account options, Axos Invest also provides Roth and standard IRAs to help you get the most out of your tax-advantaged investing.

Those who are ready to take the next step and benefit from a more comprehensive set of financial tools can turbocharge their approach with Axos Elite. A membership gives you access to longer trading hours (up to 7 p.m. ET) as well as their unique research tool – TipRanksTM – and other benefits.

3. SoFi- The best option for IPO investing

SoFi started up as a lending and banking company that assisted individuals in refinancing high-interest debts, obtaining personal loans or mortgages, and managing their money in general. SoFi also provides the option to invest in low-risk savings products as well as in the stock market. The app and desktop application both allow you to use automatic trading options as well as actively manage your account through the app.

SoFi’s automated trading ensures that your portfolio is well-diversified and safe at all times. In addition, you can begin investing with just $1.

Active investing allows you to experiment with ETFs, bonds, and stocks with no costs. You may also use SoFi to keep up with financial news, build a watchlist of stocks that you might be interested in investing in, and cash out your profits when you’re ready to take a profit. Furthermore, you can make a transfer directly from the online trading platform to your SoFi bank account.

Visit the FAQs and About Us sections of the website to discover more about the organisation, or use the Contact Us link at the bottom of each page. If you have any questions, you can contact the company by phone or email, and the company provides many phone numbers to help you reach the relevant employee.

4. TradeZero- Provides powerful services at a low cost

TradeZero is a platform that is designed to serve all of those who desire the opportunity to trade with no commissions, scale their portfolios, and take advantage of high-quality services at a low cost. TradeZero provides low- to no-cost direct market access to a variety of products and services, including:

- 24×7 Customer Service

- Mobile application with a lot of power

- This is a free version of something that other brokers charge a lot of money for.

Even if the Zero Pro dashboard is more complicated and fuller of options and nuances, the Zero Free dashboard is equally as complex and full of options and nuances. Examine the ways in which TradeZero provides free transactions, and decide if you want to stick to those securities or branch out. TradeZero assists everyone, from professionals to complete beginners, in getting started, saving money, and increasing your net worth.

5. Interactive Brokers- The cheapest of all

The award-winning platform and services offered by Interactive Brokers were created with experienced international traders in mind, and they continue to be so today. Market access is available 24 hours a day, six days a week through this really interactive broker, which allows you to trade in 135 different markets in 33 countries with 23 different currencies.

The company’s trading platforms include a simple Client Portal, its flagship platform, the Trader Workstation (TWS), as well as a mobile version for Android and iOS devices. There are two versions of the IBKR Application Programming Interface (API) available: an Excel version and a sophisticated FIX API version.

The firm’s pricing varies depending on whether you choose IBKR Lite or IBKR Pro, though equities and ETFs in the United States can be traded without paying a commission. Because investing can be tailored to fit your financial situation, you’ll never feel like you’re overpaying.