Plus500 Ltd has grown dramatically since 2008, culminating in its 2013 IPO on the AIM sector of the London Stock Exchange.

Plus500 Regulation Is it legit?

It holds more than seven licences in some of the world’s most major financial marketplaces.

Plus500 Cy Ltd is regulated by the Cyprus Securities and Exchange Commission (CySEC) under licence 250/14 and has its principal headquarters in that nation.

The Financial Conduct Authority regulates and licences Plus500 UK Ltd. (FRN 509909). Plus500AU Pty Ltd, ACN 153 301 681, AFSL 417727 issued by the ASIC (Australian Securities and Investments Commissions), is permitted to sell these products to Australian nationals. The New Zealand derivatives issuer FSP, # 486026, enables the issuance of these products to New Zealand residents. It can also be found in South Africa and Israel.

CFD titles do not grant the right to hold real assets. This broker is traded on the London Stock Exchange’s main market.

The CySEC regulation places Plus500 under rigorous financial scrutiny because it is known to investigate all of its brokers and levy significant fines if they do not strictly follow the legal processes. Plus500 is not immune to this.

The broker is a member of their clients’ money protection programs since they are protected by such a powerful legal umbrella. England and Cyprus are two of the most important, both of which are closely monitored by European organisations and legislation such as MiFID.

Plus500 Atletico Madrid

Among the highlights is its current sponsorship with Atlético de Madrid, which was inked in 2015. A partnership that has lasted more than 5 years, a record among brokers, and demonstrates the broker’s interest in gaining the market’s trust. Furthermore, at the end of 2020, this agreement was extended until 2022, demonstrating the trust between both organisations and the fact that we are engaged in a truly long-term project.

This is an important point since it demonstrates that we are dealing with a trustworthy broker who has been in the market for a long time.

It also serves as the patron of the Brummies, one of Australia’s top rugby union teams.

Customer service

One of the things that distinguishes Plus500 as a broker is that clients must contact the broker via email rather than phone, which means that the broker can save money and offer products. Highly adaptable and reasonably priced.

On the other side, many merchants dislike this because they prefer to have a phone contact in case of an issue. However, interaction through chat is available 24 hours a day, seven days a week, making it one of the most comprehensive brokers in this regard.

The main contact methods are:

- Chat 24/7

- Contact Form

Create an account with Plus500.

We will simply need to select the option to begin trading and submit our personal information, after which we will be required to establish our identification with a national identity document and evidence of domicile. For the latter, any invoice in our name, such as an electricity, water, or telephone bill, or even a bank statement with our address and name, is valid. Because of regulatory restrictions, this is required.

After the Plus500 team checks the data, we will be able to begin trading with this broker.

In any event, if we want to test the service, we just open a demo account and trade in the necessary assets. One of the benefits of the Plus500 sample account is that it does not expire, so we may use it to test various tactics for as long as we like. This is something that every new trader should do.

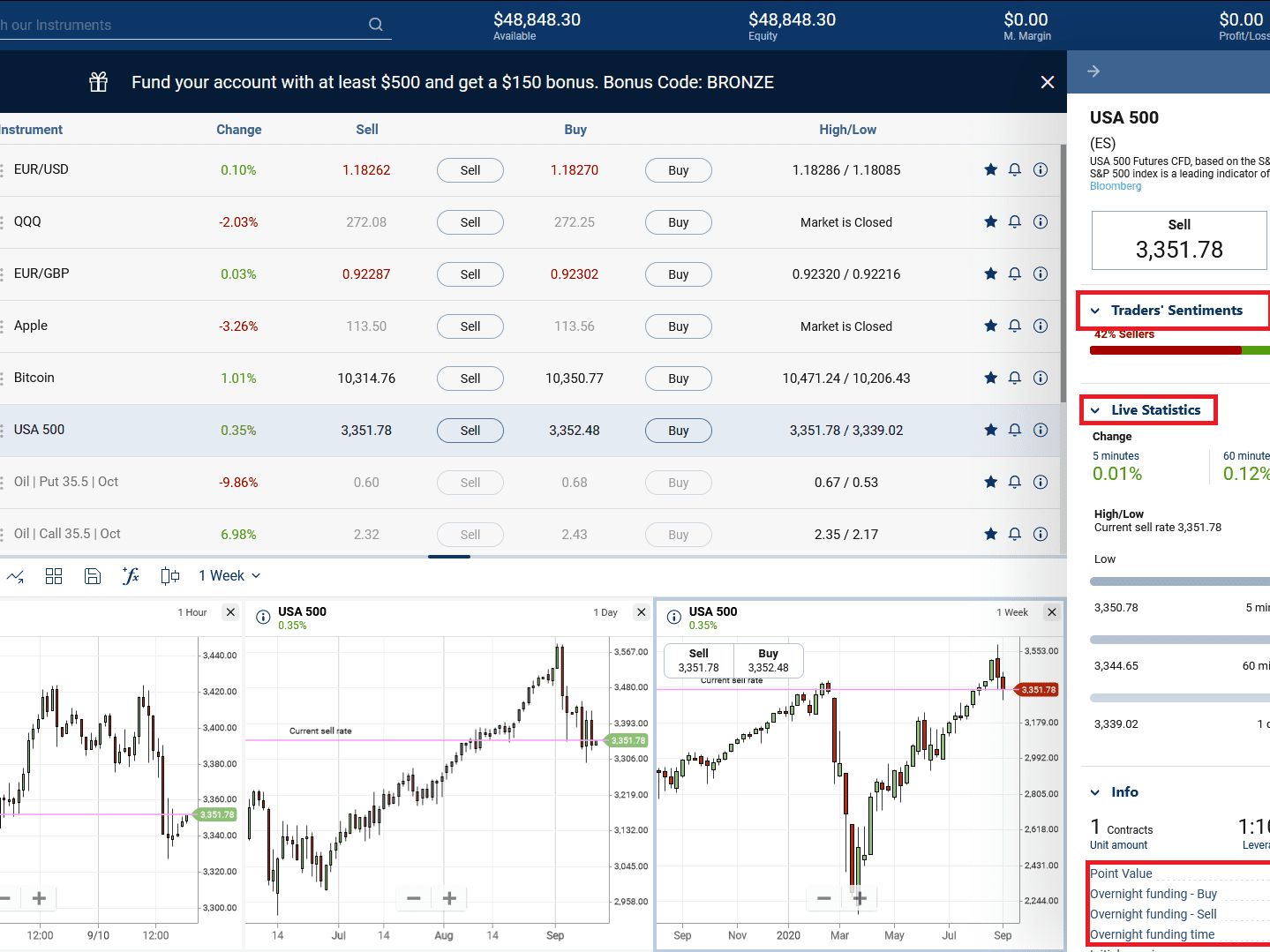

Plus500 demo account

Open a non-expiring demo account with Plus500 and experiment with their platform (77 percent of clients lose money with this provider).

If you want to start investing with this broker but don’t understand how the platform works or think you need some experience, you may open a Plus500 sample account for free.

By opening a trial account with Plus500, you will gain access to a portfolio with €40,000 to invest indefinitely until you are confident enough to invest your own money.

How can I open a Plus500 demo account?

Opening a demo account at Plus500 is simple and quick. All you have to do is follow these steps:

- To create the Plus500 demo account, go to the form.

- You can sign up for an account using your email address or by integrating your Google, Facebook, or Apple accounts.

- You will be transported to the Plus500 trading interface after choosing “Create Test Account.”

- With these three simple actions, which take less than a minute, you may begin investing in Plus500 as if it were a real account.

How do I use the Plus500 demo account to invest?

After you’ve established your account, you can access the investment app via your computer (web format) or your smartphone (app format).

You will see the main trading screen after entering in using the email and password you used to establish the account. To trade, you can look for assets in numerous ways:

In the top bar, enter the name of the company, currency, or raw material and click on it. Following that, a dialogue box will appear to allow you to change the order.

Browse the menu on the left side of the screen, where you can filter by asset type, location, or index, among other things. When you’ve discovered the asset you wish to invest in, simply click on it to bring up the previous dialogue box.

Overall, Plus500 provides a quite comprehensive demo account. It has no time limit and starts with a good virtual capital (€40,000), so you can test it till you feel comfortable.

Remember that the Plus500 demo account is for you to experiment before you start investing, therefore we encourage that you adopt an investment strategy that is as close to the one you would use with real money as feasible.

What countries do they accept?

Plus500 accepts clients from all countries in Europe and the majority of the rest of the world.

Plus500 offers clients from the following countries: Spain, Mexico, Argentina, Colombia, Chile, Peru, Uruguay, Panama, Ecuador, Dominican Republic, Bolivia, Paraguay, Venezuela, Honduras, Guatemala, El Salvador, Costa Rica, and Nicaragua.

Plus500 requires a minimum deposit of 100 euros or dollars to start an account.

This encourages many traders to choose it as their broker to begin trading in the markets, as well as any experienced trader who wants to test techniques with this broker.